Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: What Are The Financial Risks of Having Only One Primary Beneficiary?

Read more »: What Are The Financial Risks of Having Only One Primary Beneficiary?Why Do I Need A Primary Beneficiary? When you have a life insurance policy, you may be concerned with dividing up the benefit amount and who will take responsibility for your children or other dependents after your death. Additionally, there will be many obligations that need to be dealt with when you pass away. Therefore,…

-

Read more »: What Insurance premiums are tax deductible?

Read more »: What Insurance premiums are tax deductible?Understanding which insurance premiums are tax-deductible in Canada can be complex. While most are not, exceptions exist—particularly in corporate structures and lender-required policies. This article breaks down the nuances, including how business owners can strategically use life insurance in buy-sell agreements and when deductions truly apply.

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE ???? http://watchibc.com/ In this episode, Jayson Lowe and Richard Canfield dive into the concepts from their new book, Don’t Spread the Wealth, highlighting how the Infinite Banking Concept (IBC) empowers families to pay off debt and build lasting wealth. They explain how most people unknowingly transfer wealth out of their families through taxes,…

-

CLICK HERE ???? http://watchibc.com/ In this video, Sarbloh Gill explains the Infinite Banking Concept, emphasizing that wealth-building is not limited to the rich but is about controlling the flow of money! He introduces two key principles: recapturing interest and controlling the motion of money, which enable individuals to optimize their financial position. Gill outlines how…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Debt doesn’t have to be scary—if you understand how to use it. The wealthy don’t see loans as burdens; they see them as tools for financial growth. Jayson Lowe explains how loans can be managed strategically so they become an asset rather than a liability. By borrowing against a guaranteed appreciating policy, you can access…

-

Would you rather make 10% on your money—or 50%? The key difference is leverage. Jason Weiss, a financial strategist, breaks down why financing real estate accelerates wealth-building. By putting less money down, investors see higher returns without tying up all their capital. This is how the wealthy maximize every dollar they invest. Don’t let your…

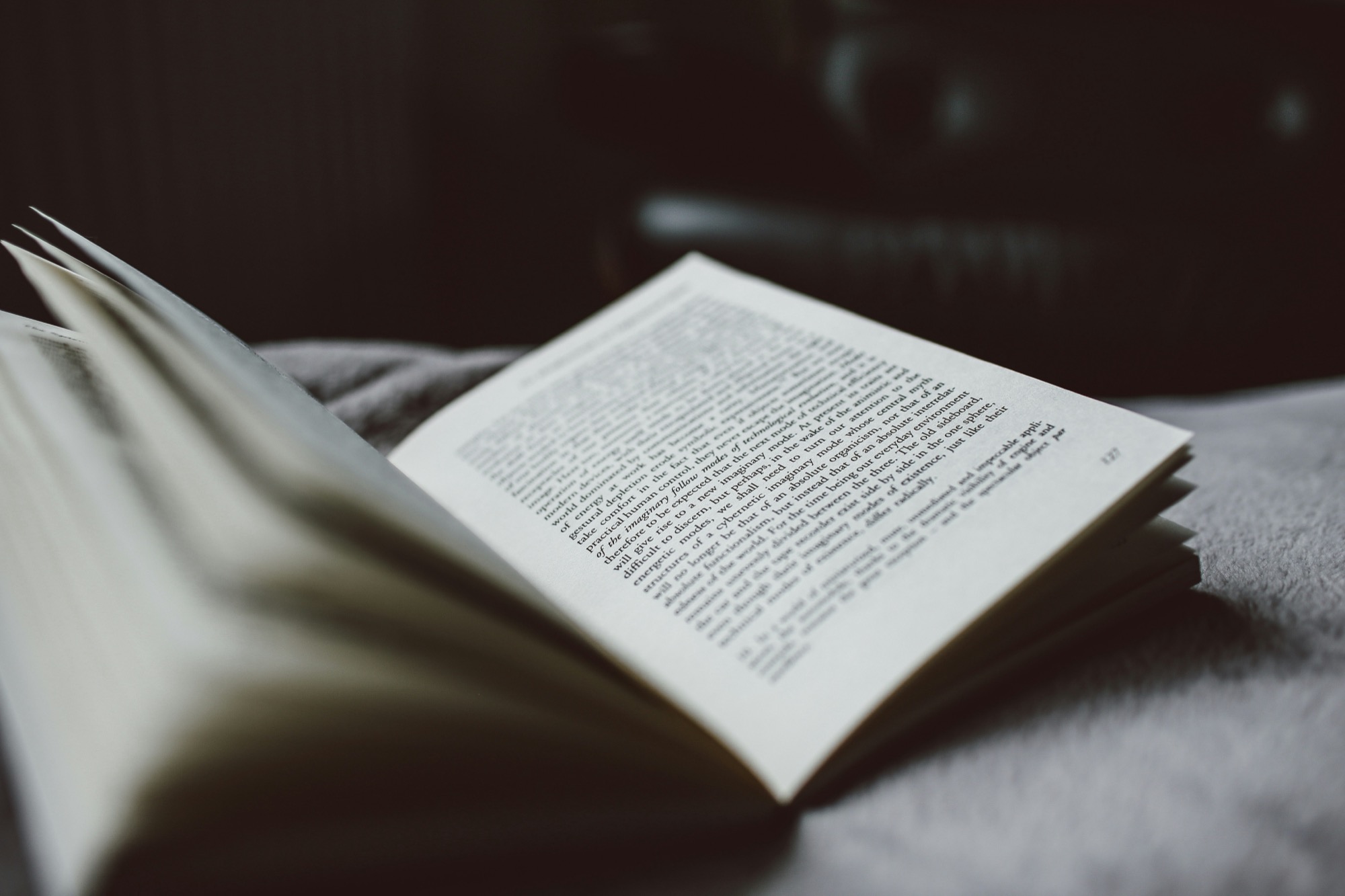

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!