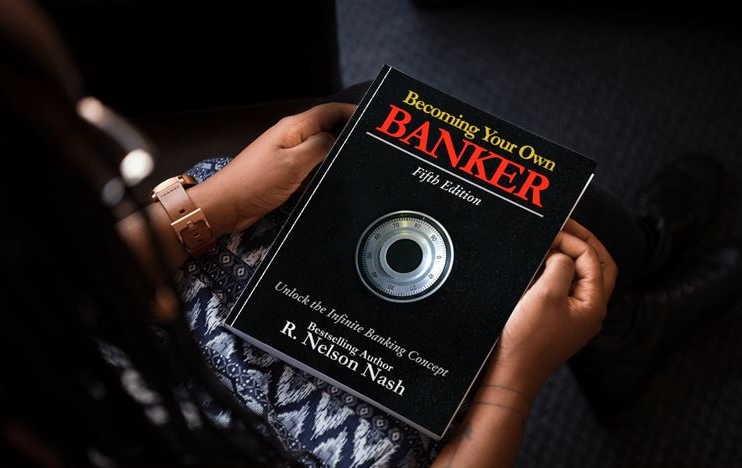

Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: How will the economy of Canada impact your registered accounts?

Read more »: How will the economy of Canada impact your registered accounts?Economic downturns can shake more than just the stock market — they can derail your retirement plans. RRSPs, while popular, are often exposed to market volatility and come with penalties for early withdrawals. Many Canadians have learned the hard way that traditional savings strategies can be inflexible when real-life emergencies strike. Rethinking where and how…

-

Read more »: The Biggest Fears Of Registered Retirement Savings Plans

Read more »: The Biggest Fears Of Registered Retirement Savings PlansIt’s important to know what the main fears of Canadians are about RRSPs to be prepared and well-informed when it comes time to make decisions about your retirement planning.

-

Read more »: Is A Group RRSP Considered Employee Benefits?

Read more »: Is A Group RRSP Considered Employee Benefits?Group RRSPs are a common but often overlooked employee benefit that can offer a convenient way to save for retirement—especially with employer contributions or matching incentives. While the automatic payroll deductions can simplify investing, there are often eligibility rules, restrictions on access, and limited investment options. Understanding how your group RRSP fits into your overall…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE ???? http://watchibc.com/ Most people think of life insurance as just a death benefit—but what if I told you it could be the most powerful financial tool you ever use while you’re still alive? In this video, we’re diving deep into high cash value life insurance—how it grows your money daily, never loses value,…

-

CLICK HERE ???? http://watchibc.com/ Compounding dividends is one of the most powerful strategies for building long-term wealth. In this video, I’ll break down how dividend reinvestment plans (DRIPs) work, why I only invest in dividend-paying stocks, and how I use the infinite banking concept to maximize returns. By reinvesting dividends into more shares, you can…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Cash flow is the real key to business health. Henry Wong justifies why cash flow is more important than profit. By breaking down cash flow into three categories—operating, investing, and financing—business owners can get a true picture of their financial health. Don’t let cash flow issues hold you back. Watch the full episode! Business Owners…

-

Treating life insurance as an expense could cost you. Henry Wong breaks down a major misconception that permanent life insurance is a specialized asset, but many mistakenly treat premiums as an expense. As he points out, the Income Tax Act clearly states that insurance premiums aren’t deductible. Avoid costly mistakes and make life insurance work…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!