Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: How will the economy of Canada impact your registered accounts?

Read more »: How will the economy of Canada impact your registered accounts?Economic downturns can shake more than just the stock market — they can derail your retirement plans. RRSPs, while popular, are often exposed to market volatility and come with penalties for early withdrawals. Many Canadians have learned the hard way that traditional savings strategies can be inflexible when real-life emergencies strike. Rethinking where and how…

-

Read more »: How Can Termination of Employment Affect Your Group RRSP?

Read more »: How Can Termination of Employment Affect Your Group RRSP?From losing employer matching to understanding transfer and withdrawal options, this article helps Canadians navigate their RRSPs post-employment—and why now might be the perfect time to take back control of your retirement strategy.

-

Read more »: What is Liability?

Read more »: What is Liability?Understanding liabilities isn’t just about balancing your books — it’s about protecting your income, your family, and your future. From debts like loans and credit cards to the often-overlooked final tax liability, knowing how to manage and plan for these obligations is critical. Learn how life insurance and proper financial planning can provide peace of…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

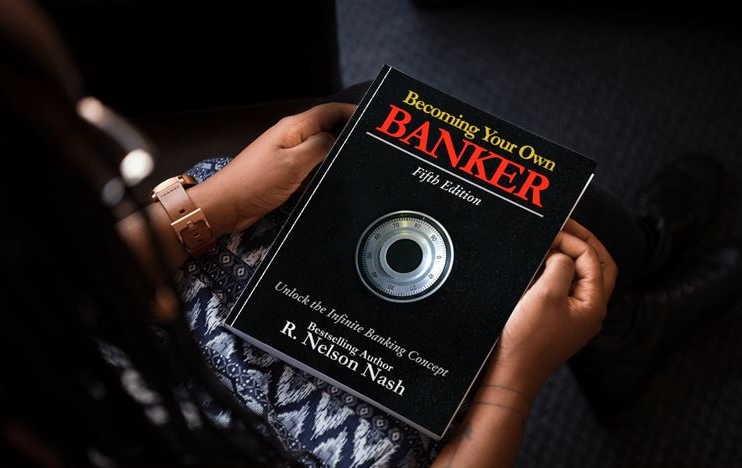

CLICK HERE ???? http://watchibc.com/ In this episode, we dive deep into the fundamentals of infinite banking and the common misconceptions surrounding cash value life insurance. The discussion centers around R. Nelson Nash’s book Becoming Your Own Banker, emphasizing the difference between purchasing a policy and implementing a banking process. Through the equipment financing example, Jayson…

-

CLICK HERE ???? http://watchibc.com/ Infinite Banking offers business owners and families a transformative way to protect and grow wealth by becoming their own banker. This video dives deep into the principles of Infinite Banking, exploring how it promotes financial independence, generational wealth building, and long-term wealth preservation. By leveraging dividend-paying whole life insurance policies, this…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Cash flow is the real key to business health. Henry Wong justifies why cash flow is more important than profit. By breaking down cash flow into three categories—operating, investing, and financing—business owners can get a true picture of their financial health. Don’t let cash flow issues hold you back. Watch the full episode! Business Owners…

-

Treating life insurance as an expense could cost you. Henry Wong breaks down a major misconception that permanent life insurance is a specialized asset, but many mistakenly treat premiums as an expense. As he points out, the Income Tax Act clearly states that insurance premiums aren’t deductible. Avoid costly mistakes and make life insurance work…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!