Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: How Can Termination of Employment Affect Your Group RRSP?

Read more »: How Can Termination of Employment Affect Your Group RRSP?From losing employer matching to understanding transfer and withdrawal options, this article helps Canadians navigate their RRSPs post-employment—and why now might be the perfect time to take back control of your retirement strategy.

-

Read more »: How will the economy of Canada impact your registered accounts?

Read more »: How will the economy of Canada impact your registered accounts?Economic downturns can shake more than just the stock market — they can derail your retirement plans. RRSPs, while popular, are often exposed to market volatility and come with penalties for early withdrawals. Many Canadians have learned the hard way that traditional savings strategies can be inflexible when real-life emergencies strike. Rethinking where and how…

-

Read more »: The Biggest Fears Of Registered Retirement Savings Plans

Read more »: The Biggest Fears Of Registered Retirement Savings PlansIt’s important to know what the main fears of Canadians are about RRSPs to be prepared and well-informed when it comes time to make decisions about your retirement planning.

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE ???? http://watchibc.com/ Most people think of life insurance as just a death benefit—but what if I told you it could be the most powerful financial tool you ever use while you’re still alive? In this video, we’re diving deep into high cash value life insurance—how it grows your money daily, never loses value,…

-

CLICK HERE ???? http://watchibc.com/ Compounding dividends is one of the most powerful strategies for building long-term wealth. In this video, I’ll break down how dividend reinvestment plans (DRIPs) work, why I only invest in dividend-paying stocks, and how I use the infinite banking concept to maximize returns. By reinvesting dividends into more shares, you can…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

What if you could finance an asset that only grows in value? Unlike cars, boats, or real estate that can lose value over time, a properly structured whole life insurance policy is a guaranteed appreciating asset. Jason Weiss, a financial strategist, explains why premium financing is a game-changer for business owners. Instead of worrying about…

-

Selling a business is a big milestone—but where will you put that money? Jason Weiss, a financial strategist, explains how premium financing and properly structured whole life insurance policies can serve as the perfect warehouse for liquidity. Instead of parking funds in a bank where they lose value, business owners can use their policies to…

Ready for more?

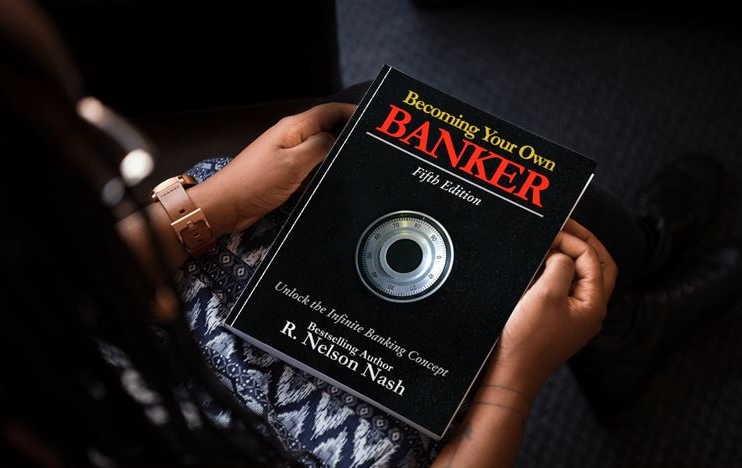

Secure your spot in our online training and discover how to Become Your Own Banker!