Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: The Biggest Fears Of Registered Retirement Savings Plans

Read more »: The Biggest Fears Of Registered Retirement Savings PlansIt’s important to know what the main fears of Canadians are about RRSPs to be prepared and well-informed when it comes time to make decisions about your retirement planning.

-

Read more »: Is A Group RRSP Considered Employee Benefits?

Read more »: Is A Group RRSP Considered Employee Benefits?Group RRSPs are a common but often overlooked employee benefit that can offer a convenient way to save for retirement—especially with employer contributions or matching incentives. While the automatic payroll deductions can simplify investing, there are often eligibility rules, restrictions on access, and limited investment options. Understanding how your group RRSP fits into your overall…

-

Read more »: Five Things You Should Know About Registered Retirement Income Funds

Read more »: Five Things You Should Know About Registered Retirement Income FundsWhile RRSPs help you grow savings tax-deferred, RRIFs require you to start drawing income and paying taxes, often affecting government benefits and estate planning. Understanding how and when to convert your RRSP into a RRIF is key to avoiding costly surprises.

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE ???? http://watchibc.com/ Most people think of life insurance as just a death benefit—but what if I told you it could be the most powerful financial tool you ever use while you’re still alive? In this video, we’re diving deep into high cash value life insurance—how it grows your money daily, never loses value,…

-

CLICK HERE ???? http://watchibc.com/ Compounding dividends is one of the most powerful strategies for building long-term wealth. In this video, I’ll break down how dividend reinvestment plans (DRIPs) work, why I only invest in dividend-paying stocks, and how I use the infinite banking concept to maximize returns. By reinvesting dividends into more shares, you can…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

ORDER A COPY OF OUR NEW BOOK! Don’t Spread the Wealth: How to Leverage the Family Banking System to Own All the Gold, Make the Rules, and Enjoy Generational Riches https://www.amazon.ca/Dont-Spread-Wealth-Leverage-Generational-ebook/dp/B0CW19QSGT/ Website: https://dontspreadwealth.com/ Cash flow is king. But are you managing yours like the ultra-wealthy? In this episode, Jason Weiss collaborates with us to break…

-

ORDER A COPY OF OUR NEW BOOK! Don’t Spread the Wealth: How to Leverage the Family Banking System to Own All the Gold, Make the Rules, and Enjoy Generational Riches https://www.amazon.ca/Dont-Spread-Wealth-Leverage-Generational-ebook/dp/B0CW19QSGT/ Website: https://dontspreadwealth.com/ If you’re not fluent in the language of financial statements, you’re missing opportunities to grow, optimize, and protect your business. Hosts Richard…

Ready for more?

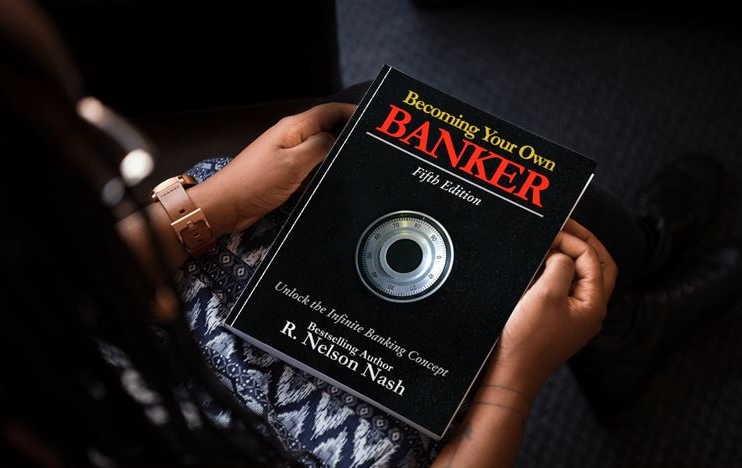

Secure your spot in our online training and discover how to Become Your Own Banker!