Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: What is Liability?

Read more »: What is Liability?Understanding liabilities isn’t just about balancing your books — it’s about protecting your income, your family, and your future. From debts like loans and credit cards to the often-overlooked final tax liability, knowing how to manage and plan for these obligations is critical. Learn how life insurance and proper financial planning can provide peace of…

-

Read more »: How Can Termination of Employment Affect Your Group RRSP?

Read more »: How Can Termination of Employment Affect Your Group RRSP?From losing employer matching to understanding transfer and withdrawal options, this article helps Canadians navigate their RRSPs post-employment—and why now might be the perfect time to take back control of your retirement strategy.

-

Read more »: How will the economy of Canada impact your registered accounts?

Read more »: How will the economy of Canada impact your registered accounts?Economic downturns can shake more than just the stock market — they can derail your retirement plans. RRSPs, while popular, are often exposed to market volatility and come with penalties for early withdrawals. Many Canadians have learned the hard way that traditional savings strategies can be inflexible when real-life emergencies strike. Rethinking where and how…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE ???? http://watchibc.com/ Welcome back to Bankers Vault! Today, we break down the key concepts of financial independence versus financial freedom and introduce the family banking system as a powerful way to control the banking function in your life. We explain how to free up cash flow through debt recapture, build a sustainable system…

-

CLICK HERE ???? http://watchibc.com/ In this video, Richard Canfield and Jayson Lowe break down the Infinite Banking Concept (IBC), emphasizing that it’s not just a financial strategy but a lifestyle shift. They explain how traditional banking systems systematically drain wealth through taxes, interest, and fees, and how IBC helps individuals regain control of their finances.…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Debt doesn’t have to be scary—if you understand how to use it. The wealthy don’t see loans as burdens; they see them as tools for financial growth. Jayson Lowe explains how loans can be managed strategically so they become an asset rather than a liability. By borrowing against a guaranteed appreciating policy, you can access…

-

Would you rather make 10% on your money—or 50%? The key difference is leverage. Jason Weiss, a financial strategist, breaks down why financing real estate accelerates wealth-building. By putting less money down, investors see higher returns without tying up all their capital. This is how the wealthy maximize every dollar they invest. Don’t let your…

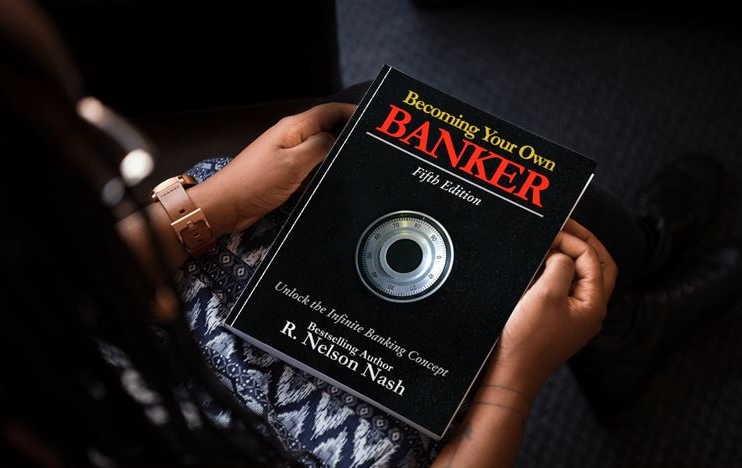

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!