Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: What Are The Financial Risks of Having Only One Primary Beneficiary?

Read more »: What Are The Financial Risks of Having Only One Primary Beneficiary?Why Do I Need A Primary Beneficiary? When you have a life insurance policy, you may be concerned with dividing up the benefit amount and who will take responsibility for your children or other dependents after your death. Additionally, there will be many obligations that need to be dealt with when you pass away. Therefore,…

-

Read more »: What is Liability?

Read more »: What is Liability?Understanding liabilities isn’t just about balancing your books — it’s about protecting your income, your family, and your future. From debts like loans and credit cards to the often-overlooked final tax liability, knowing how to manage and plan for these obligations is critical. Learn how life insurance and proper financial planning can provide peace of…

-

Read more »: How Can Termination of Employment Affect Your Group RRSP?

Read more »: How Can Termination of Employment Affect Your Group RRSP?From losing employer matching to understanding transfer and withdrawal options, this article helps Canadians navigate their RRSPs post-employment—and why now might be the perfect time to take back control of your retirement strategy.

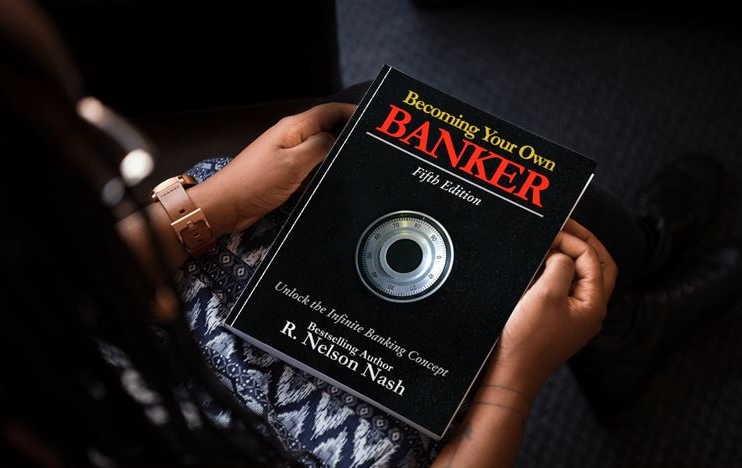

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE ???? http://watchibc.com/ In this video, Jayson and Richard break down how the Infinite Banking Concept (IBC) can help you pay off debt while building wealth at the same time. They compare traditional debt repayment methods to using IBC, showing how most people are losing money without even realizing it. By using dividend-paying whole…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

What if you could finance an asset that only grows in value? Unlike cars, boats, or real estate that can lose value over time, a properly structured whole life insurance policy is a guaranteed appreciating asset. Jason Weiss, a financial strategist, explains why premium financing is a game-changer for business owners. Instead of worrying about…

-

Selling a business is a big milestone—but where will you put that money? Jason Weiss, a financial strategist, explains how premium financing and properly structured whole life insurance policies can serve as the perfect warehouse for liquidity. Instead of parking funds in a bank where they lose value, business owners can use their policies to…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!