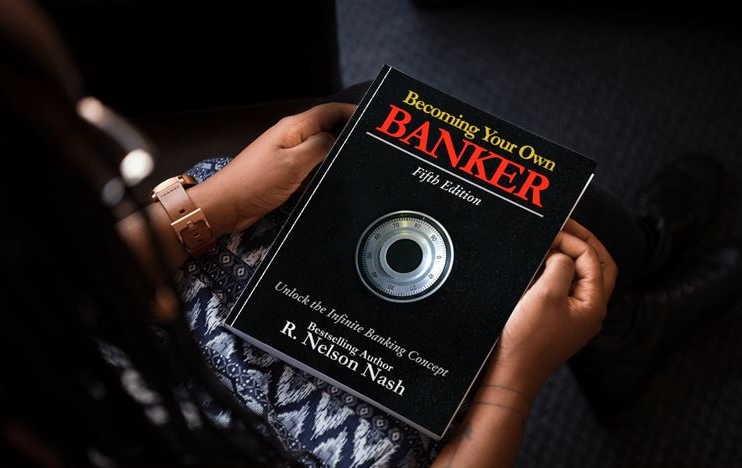

Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: Return On Investments in Canada

Read more »: Return On Investments in CanadaUnderstanding Return on Investment (ROI) goes far beyond simple math—it’s about measuring value in real, personal, and financial terms. Learn how ROI can guide your financial decisions in business and life, and why emotional or lifestyle returns sometimes matter just as much as the numbers.

-

Read more »: Beneficiary of inheritance: What to do, Pay debts

Read more »: Beneficiary of inheritance: What to do, Pay debtsCanada is in the middle of an unprecedented $1 trillion wealth transfer—and if you’re a beneficiary, what you do next matters more than ever. Inheriting money is more than a financial event; it’s a moment to pause, reflect, and plan with purpose. Learn how to preserve and grow your inheritance while honoring the legacy behind…

-

Read more »: How To Handle Beneficiaries During Divorce

Read more »: How To Handle Beneficiaries During DivorceDivorce is a major life transition—and amid the legal and emotional complexity, updating your life insurance beneficiaries often gets overlooked. Whether your ex is still listed as your primary beneficiary or your children need a trustee, now is the time to ensure your policies reflect your new reality. Learn how to protect your assets and…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE ???? http://watchibc.com/ As you grow your success in life and business, expanding your personal banking system is essential. The Infinite Banking Concept (IBC) allows you to become your own banker, redirecting cash flow through dividend-paying whole life insurance policies, creating both growth and access to capital. By understanding the four distinct stages—Saver, Capital…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Selling a business is a big milestone—but where will you put that money? Jason Weiss, a financial strategist, explains how premium financing and properly structured whole life insurance policies can serve as the perfect warehouse for liquidity. Instead of parking funds in a bank where they lose value, business owners can use their policies to…

-

Debt doesn’t have to be scary—if you understand how to use it. The wealthy don’t see loans as burdens; they see them as tools for financial growth. Jayson Lowe explains how loans can be managed strategically so they become an asset rather than a liability. By borrowing against a guaranteed appreciating policy, you can access…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!