Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: Why you don’t need a professional certification in financial services

Read more »: Why you don’t need a professional certification in financial servicesMany Canadians believe credentials are required to make sound financial decisions, but experience, communication, and a proven track record often matter more.

-

Read more »: Five Things You Should Know About Registered Retirement Income Funds

Read more »: Five Things You Should Know About Registered Retirement Income FundsWhile RRSPs help you grow savings tax-deferred, RRIFs require you to start drawing income and paying taxes, often affecting government benefits and estate planning. Understanding how and when to convert your RRSP into a RRIF is key to avoiding costly surprises.

-

Read more »: Is A Group RRSP Considered Employee Benefits?

Read more »: Is A Group RRSP Considered Employee Benefits?Group RRSPs are a common but often overlooked employee benefit that can offer a convenient way to save for retirement—especially with employer contributions or matching incentives. While the automatic payroll deductions can simplify investing, there are often eligibility rules, restrictions on access, and limited investment options. Understanding how your group RRSP fits into your overall…

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

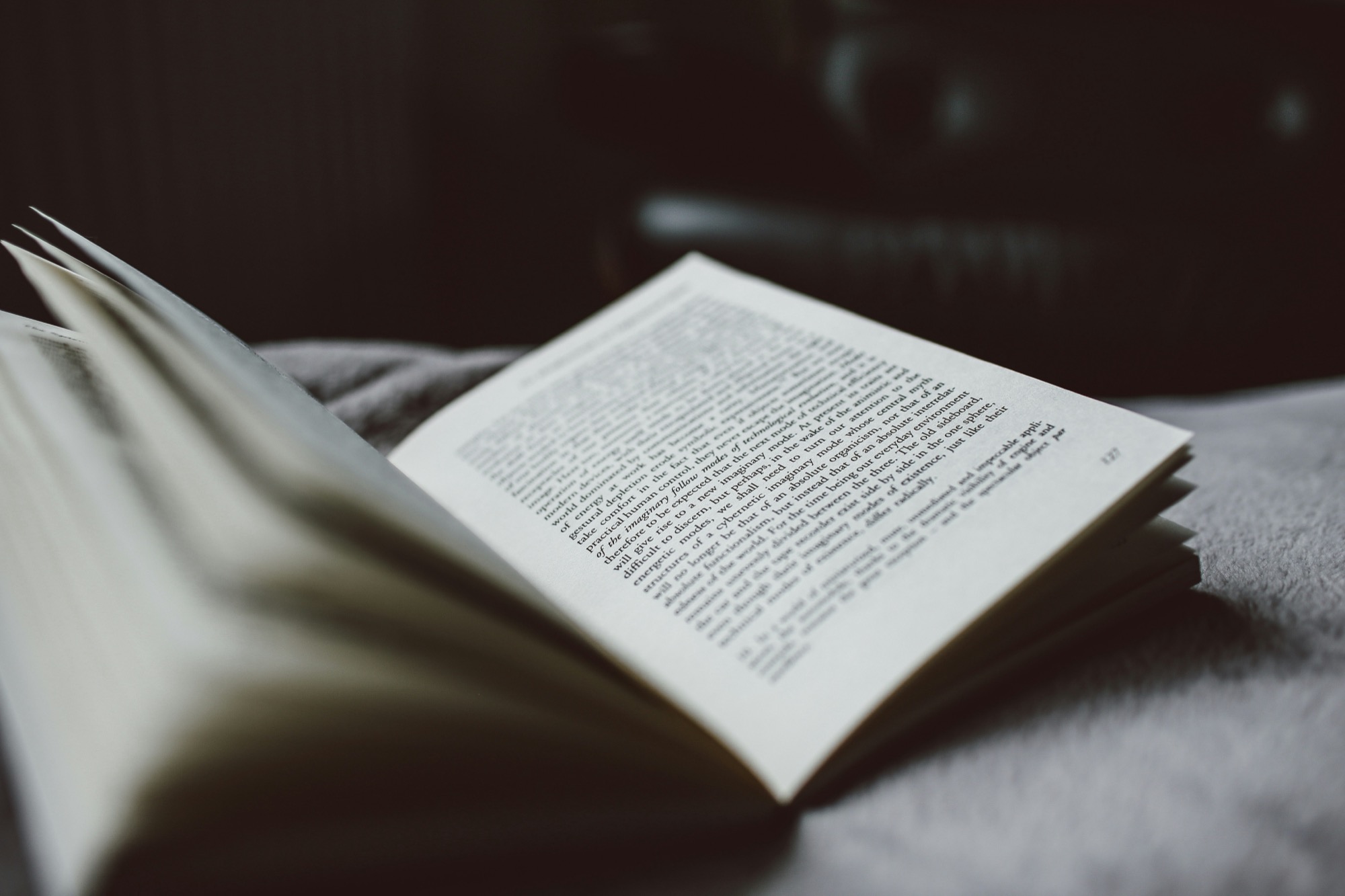

CLICK HERE ???? http://watchibc.com/ This episode dives into Nelson Nash’s Becoming Your Own Banker and the power of infinite banking using dividend-paying whole life insurance. Jayson and Richard break down key financial principles, including the importance of repaying policy loans, thinking long-term, and keeping money within the family banking system. They contrast traditional banking with…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

ORDER A COPY OF OUR NEW BOOK! Don’t Spread the Wealth: How to Leverage the Family Banking System to Own All the Gold, Make the Rules, and Enjoy Generational Riches https://www.amazon.ca/Dont-Spread-Wealth-Leverage-Generational-ebook/dp/B0CW19QSGT/ Website: https://dontspreadwealth.com/ Are you making your money work as hard as possible? The right financing strategy can amplify your returns, reduce risks, and create…

-

ORDER A COPY OF OUR NEW BOOK! Don’t Spread the Wealth: How to Leverage the Family Banking System to Own All the Gold, Make the Rules, and Enjoy Generational Riches https://www.amazon.ca/Dont-Spread-Wealth-Leverage-Generational-ebook/dp/B0CW19QSGT/ Website: https://dontspreadwealth.com/ Your financial statements tell a story. Are you reading yours correctly? Hosts Richard Canfield and Henry Wong dive into the most common…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!