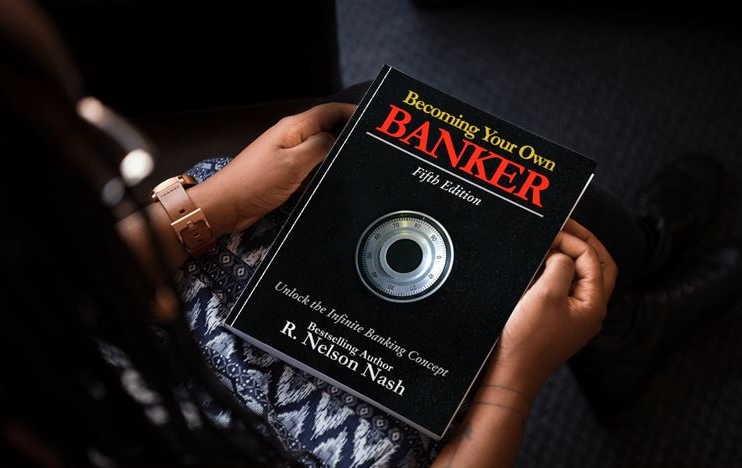

Master the Concept of Infinite Banking

The Money Blog

Read through our collection of articles on the Infinite Banking Concept (IBC) and other money matters.

-

Read more »: Debt management: Budgets, Options, Consolidation, Creditors

Read more »: Debt management: Budgets, Options, Consolidation, CreditorsDebt management is a process typically spearheaded by a financial counselor who helps individuals who find themselves spiraling in debt, particularly unsecured debts such as credit card debt.

-

Read more »: What should every Canadian Know about Your Will?

Read more »: What should every Canadian Know about Your Will?Do you want to control the allocation of your property even after your death? Well, a will is an excellent way of achieving this. Creating a will is not a walk in the park. There are several things that every Canadian should know about a will. First and foremost, it’s essential to understand that your…

-

Read more »: Planning Your Financial independence

Read more »: Planning Your Financial independenceTo achieve financial independence, you have to plan your financial course with care. It is not an easy task since there are no one-size-fits-all formulas that you can follow because the variables keep changing. However, there are actionable steps you can take.

The Premier Channel: Bankers Vault

Watch out our latest videos and tutorials on the Infinite Banking Concept and other financial topics.

-

CLICK HERE ???? http://watchibc.com/ Most people think of life insurance as just a death benefit—but what if I told you it could be the most powerful financial tool you ever use while you’re still alive? In this video, we’re diving deep into high cash value life insurance—how it grows your money daily, never loses value,…

-

CLICK HERE ???? http://watchibc.com/ Compounding dividends is one of the most powerful strategies for building long-term wealth. In this video, I’ll break down how dividend reinvestment plans (DRIPs) work, why I only invest in dividend-paying stocks, and how I use the infinite banking concept to maximize returns. By reinvesting dividends into more shares, you can…

The Podcast: Wealth on Main Street

North America’s #1 financial podcast where conversations about money are entertaining and informative. We’re transforming the conversation around money, making it approachable and clear.

-

Selling a business is a big milestone—but where will you put that money? Jason Weiss, a financial strategist, explains how premium financing and properly structured whole life insurance policies can serve as the perfect warehouse for liquidity. Instead of parking funds in a bank where they lose value, business owners can use their policies to…

-

Debt doesn’t have to be scary—if you understand how to use it. The wealthy don’t see loans as burdens; they see them as tools for financial growth. Jayson Lowe explains how loans can be managed strategically so they become an asset rather than a liability. By borrowing against a guaranteed appreciating policy, you can access…

Ready for more?

Secure your spot in our online training and discover how to Become Your Own Banker!